Blockchain

Executive Summary

- Blockchains remove several bottlenecks common to traditional financial services such as speed, cost and security of transactions.

- The nascent stage of development of blockchain technologies allows several opportunities to early adopters and investors in industries, governments and individual users.

- The move from proof-of-work to proof-of-stake and proof-of-space-and-time is headed in the right direction as blockchains seek to reduce their carbon footprint.

- The transparency and inclusivity made possible by blockchains make social transformation possible on a large scale.

Finance as we know it is undergoing a rapid change through the digitization of data. While digital records and tools have been around at least since the second half of the twentieth century, what is happening to finance now due to the application of digital tools is expected to transform money, banks, trading, and custodial and fiduciary intermediaries forever.

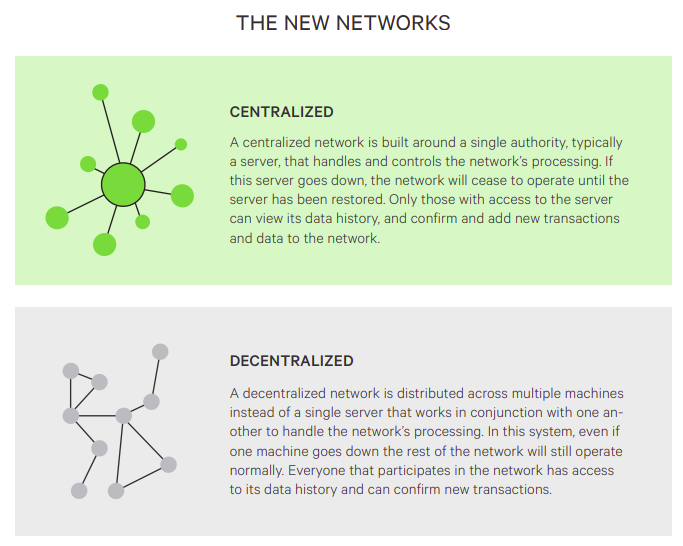

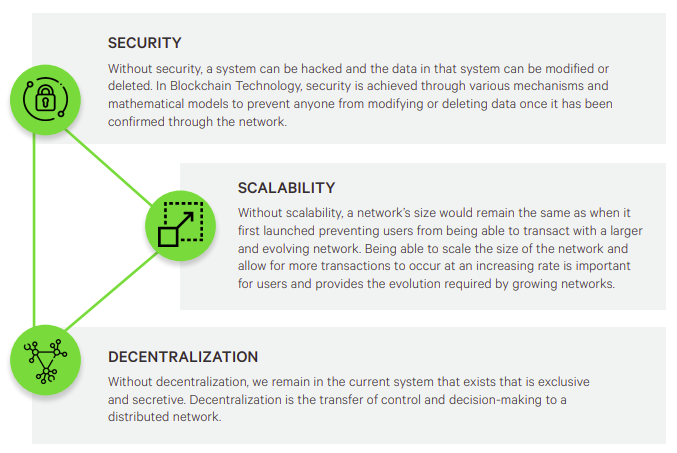

Digitization makes data repeatable and accessible from anywhere in the world. These two features make it possible to have distributed ledgers that are maintained by several computers simultaneously across the world. A distributed ledger is a way of keeping records that is not owned by a single entity or person. All users collectively own the records and so any change made to such a ledger would require the consent of other users. Once such a change is made, all users will have to accept that change as a valid one.

These decentralized ledgers that are replacing manual records, centralized servers and databases are helping redefine the way trust operates in financial transactions.

Trust is a critical factor that influences all financial transactions. When two people or institutions come together to transact, they need a trusted person who will

- Verify the transaction and certify its authenticity

- Set fair and equal terms of the transaction, including the price, fees, and size of the transaction

- Maintain records of that transaction

These requirements gave rise to an entire ecosystem that we call the financial system today. The system includes banks, custodians, fiduciary bodies, brokers, fund managers and investors.

However, this system has a few drawbacks:

- Verifying and record keeping are time consuming activities and slow down even urgent transactions.

- The fees paid for ensuring trust in a transaction through the financial system is hefty.

- Records are sometimes subject to interpretation and this can result in ambiguity.

- In rarer cases, records can be tampered with resulting in serious consequences and financial loss.

To overcome some of the drawbacks, Satoshi Nakamoto combined the latest theories and applications in cryptography, game theory, behavioral economics, computer science and portfolio management and proposed a new technology called the blockchain. Cryptography is the science of coding and involves the use of software that effectively hides information that is being sent from one entity to another. Game theory was a revolutionary breakthrough in Economics that emphasized the idea of efficiency through consensus rather than through a single authority. Both cryptography and game theory are now being extended to investments and finance and the result in a digital revolution that is transforming the way we handle money and assets

WHAT IS BLOCKCHAIN?

Blockchain is a digital records system that ensures trust amongst its users without the use of the third parties such as banks and fiduciaries. While traditional banks are trusted separate entities that validate transactions, they can have inbuilt inefficiencies since only one entity holds the records. Steep costs are incurred since the entity holding the records charges a fee. Further transactions can be tampered with since there is no second authority to ensure the validity of a transaction.

In contrast, blockchain works on a distributed peer to peer network of nodes or computers that verify and record transactions. Since no single person or entity owns this record, data stored on a blockchain is almost impossible to tamper with. Since all users hold the records, there is no need for a separate entity to validate the transactions.

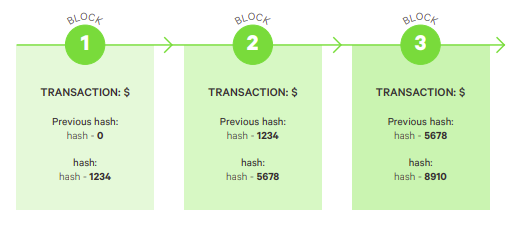

Blockchains arrange data in a chronological order and each new block is chained to earlier blocks of verified data. The verification involves solving a complex cryptographic puzzle. Once solved, the block has a unique hash through which it is identified. This is then placed in a chain of blocks.

The use of cryptographic codes makes transactions secure and pseudonymous. The cryptographic key or signature hides the identity of the individual and since these codes are visible to all users, it is almost impossible to hack them.

THE LONGEST CHAIN

Nodes are computers on a blockchain that have the software to recognize the blockchain and that have the entire history of transactions that have occurred on the blockchain. Nodes ensure that all transactions follow the protocol for the blockchain that they are on. Besides holding those immutable records, some nodes, called mining nodes, also verify transactions. Once a transaction is verified, it is added to the network as a block. Other nodes then accept the new block as valid. Over time, the chain with valid transactions will be the longest chain and this in turn is proof that the transactions on that chain are valid. The longest chain is measured in terms of what is called ‘chainwork’. This measures the amount of work that was needed to build the chain to its current length. This is equal to the total number of hashes needed to mine each block on the chain. Adopting the longest chain allows all nodes to have the same view of the blockchain. The longest chain ensures that no single individual can tamper with any block on the chain since the cumulative work done to make the chain cannot be done by a single node.

The longest chain of blocks is automatically picked up as nodes start a new block. In case two different versions of a block are communicated, nodes will work on the one they receive first but will save the other one. When the next proof-of-work is done and one version is found to be longer, nodes will accept the longer one as the valid one and switch to it.

HOW DOES

BLOCKCHAIN

WORK?

MERKLE TREE

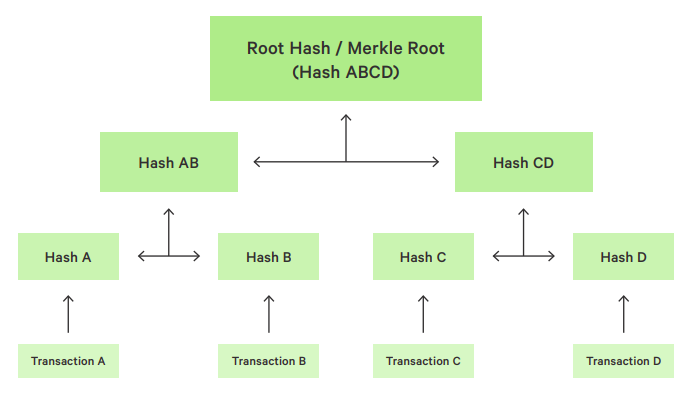

Blockchains operate through a mathematical data structure called the Merkle Tree. Named after the inventor, Ralph Merkle, who patented this new idea in 1979, a Merkle Tree is also called a Hash Tree and is made up of hashes of different blocks of data. It is a summary of all transactions in a block and this makes it possible to quickly verify a block. The first entry in each block is the hash of the previous block.

The Merkle tree allows users to know if a transaction has been included in a block. Pairs of nodes are calculated repeatedly until only one hash is left. This hash is called the Merkle Root or Root Hash for all the transactions in the current block. This is stored in the block header, the part of the block that gets hashed during mining. This ensures that the block is tamper proof. By storing just the hash of all the transactions in the block, the Root Hash also saves disk space.

Even if a single detail of a transaction on a block is changed, this will immediately result in a change in the hash for that transaction. This would then be reflected up the Merkle Tree to the Hash Root and so it is easy to check if the data on a block is accurate and authentic.

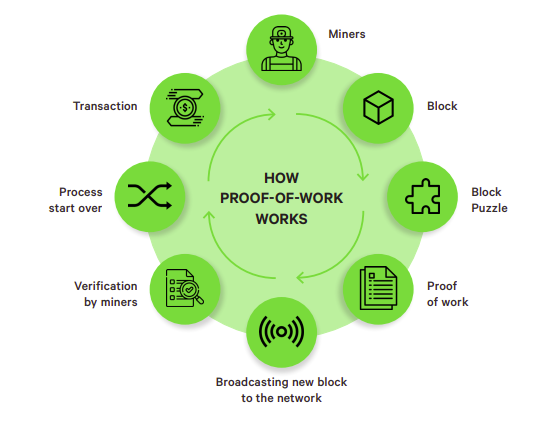

PROOF-OF-WORK

Blockchains use different methods to validate transactions. A proof-of-work shows that work has actually been done to verify a transaction. This involves scanning data for a value that when hashed begins with a number of zero bits. The work this involves is proportional to the number of zero bits needed. Once the proof-of-work is complete, a transaction is validated. The only way the block can be changed is by redoing the work. Since blocks that come after a given block carry the hash tag of the earlier block, any change in a block would change all future blocks. So all future blocks would also have to be changed.

The greatest proof-of-work done is reflected in the longest chain since a majority of nodes would have validated that chain. Any attempt to undo the work completed is made difficult and slow since all the blocks that come after will also have to be undone. So most of the computing power is used in validating transactions that are authentic. The longer the chain, the more difficult it is to tamper with a block on it since any change in one block will have to be repeated in all blocks that come after the changed block.

Proof-of-work is also used to make decisions regarding governance and rules of the blockchain. It works on the principle of one CPU, one vote.

DECENTRALIZED NETWORK

Transactions on a blockchain occur on a decentralized network of nodes.

The process is as follows

- All new transactions are communicated to all the nodes on a network.

- Every node gathers these transactions into a block

- Each node now starts the process of validating the transactions by searching for the proofof-work.

- When a node finds the proof-of-work for a transaction, it communicates this to all other nodes on the chain.

- Other nodes check whether the transaction has been already spent before accepting the block.

- The nodes that accept the block start creating the next block and use the hash of the accepted block as the new block’s first hash.

PROOF-OF-STAKE

While proof-of-work ensures the validity of transactions that users depend on in order to trust the blockchain, there are certain challenges with this method of validation.

The time taken in order to validate a transaction slows down the speed and this poses challenges when a blockchain is scaling up to more users. As more transactions occur at faster rates, proof-ofwork has been found to slow down the verification process and so limit the number of transactions a blockchain can handle in a minute. For example, bitcoin’s proof-of-work takes 10 minutes per block and this is a significant bottleneck as the network seeks to speed up.

Secondly, the energy consumption of proof-of-work is raising concerns that the carbon footprint of blockchain technologies make them environmentally undesirable. Hashing is nothing but computer power and proof-of-work often calls for enormous consumption of energy to generate the computer power to hash and solve cryptographic puzzles.

Proof-of-stake seeks to address both the challenge of scaling and of energy consumption through the idea of staking a token. In order to validate a transaction, rather than solve cryptographic puzzles which take time and energy, a node will simply stake a native coin or a coin that is part of the blockchain the node is participating in. All nodes that wish to participate in the validation of transactions have to stake a minimum number of coins. Then they seek to arrive at an agreement about what transactions should be added to a block. If their block is selected by the network’s protocol, the nodes are rewarded with new coins whose value is proportional to the number of coins they staked in the first place. Proof-of-stake also aligns the interests of nodes with the objective of reducing the risk of hacks. Since the nodes have their own coins staked, hacking the chain becomes less attractive than if the node had to spend energy in order to mine a new coin.

PROOF-OF-SPACE-AND-TIME

When nodes reserve storage space on a network, this can be taken as an indication of their interest. When a node makes a commitment to reserve some storage space for the network, it is a one-time setup and this helps avoid the ongoing energy expenditure that proof-of-work requires. Once the space is allocated, the software installed collects cryptographic numbers into ‘plots’. When a new transaction has to be validated on the network, the users can search to see if they have the hash that matches the requirement. The probability that a user will win is directly related to the size of the plot as a part of the total sum of plots on the network. Since many computers can come up with solutions at the same time, a proof-of-time algorithm spaces the time interval between two validations. This ensures that the validation is never parallel amongst the several computers on the network.

GOVERNANCE

Deciding and updating the rules of a blockchain is an important part of being able to use the blockchain. The governance of a blockchain involves the opinions of several stakeholders, including token holders, network validators and miners, core and application developers and founders all of whom seek greater bargaining power and influence in the governance of a blockchain. Governance is either on-chain or off-chain.

On-chain governance is made within the protocol itself and affects the way a blockchain can be modified by some categories of stakeholders. Off-chain governance deals with governance structures outside the protocol such as managing companies that have been funded by token sales.

USE CASES

OF BLOCKCHAIN

SECURE TRANSACTIONS

Blockchains use a hash function for every transaction. Each input string is hashed into an output of fixed length called the hash. Each block has a unique hash that works like a fingerprint and this enables users to identify the block without identifying the person who made the transaction behind the hash. This is because the cryptographic hash works only in one direction, turning an input of any length into the hash. This process does not work the other way and so the original information cannot be retrieved. Coinbase which works entirely on encryption is available in several countries and its secure blockchain allows users to store their cryptocurrencies and passwords safely

CHEAPER

Unlike third party centralized intermediaries, blockchain’s peer to peer network allows transactions to be recorded at each node, making the ledger of transactions truly distributed. Since no single entity is in charge, the fees associated with centralized record keeping and validation don’t exist, making blockchains cheaper. While usually bank accounts call for a minimum deposit and go through elaborate checks, blockchain transactions sometimes only require a cell phone.. For example, huge transactions and transfers have been made on blockchains for a few cents in fiat money..

INCLUSIVE

Because of the peer to peer network, almost anyone can complete transactions on a blockchain. The usual KYC and in person communication that banks require is not needed to participate in blockchain enabled transactions. A 2018 report by the UN Research Institute for Social Development explored blockchain as the next step in sustainable development.

Additionally, according to the Chainalysis Crime Reports, criminal activity represented 2.1% of all cryptocurrency transactions in 2019 – approximately $21.4 billion. However, that number greatly decreased to 0.34% in 2020 – approximately $10 billion.

OTHER APPLICATIONS

Unbanked populations: Blockchains have the ability to go beyond traditional banking services and reach the unbanked populations. Since there is no single ownership and all transactions are immutable, blockchains can be used by anyone and for any kind of transaction without the fear of tampering. Compound and Aave make it possible for almost anyone to have access to several financial functions, such as lending, collateralizing and borrowing.

Cross-border payments: Today, fiat or conventional sovereign currencies are bound by national boundaries and this sometimes makes cross-border payments difficult, time-consuming and expensive. Blockchains enable cross border payments through cryptocurrencies that are borderless. The speed of transactions is much higher on a blockchain and the cost is often a fraction of the usual transaction fees charged by banks that facilitate cross border payments. Ripple works with large banks like the Bank of America and American Express and already has a huge presence in making cross border payments faster and cheaper

Smart contracts: Blockchains can set algorithms that execute certain functions based on certain conditions. For example, a blockchain protocol can set the conditions for the paying the rent on the 1st of every month without the use of an intermediary. Smart contracts are programs on a blockchain that are applied when certain conditions are met. Smart contracts are self-executing tools that are fully automated. Rather like vending machines that release a bar of chocolate when a dollar bill is inserted and the right number is punched in, smart contracts get activated when the conditions for activation are met.

Industry applications: Companies in several sectors such as travel, real estate, energy, healthcare, and advertising can use blockchains in order to rule out intermediaries, to record tamper-proof transactions and to reduce the fees usually charged for records. Propy, a real estate agent uses smart contracts to facilitate the purchase of property. The French airline Fizzy AXA uses smart contracts for flight insurance for its customers.

Voting: Blockchains can bring transparency to political processes like voting since each vote can be recorded for ever in the decentralized ledger.

Blockchains are already in use extensively in industries, governments and other organizations. Their compelling value as immutable records that cannot be tampered with has already resulted in revolutionary applications in finance and other sectors. The transparency of records with their pseudonymity are also much-sought after features and this is leading to wide-spread adoption of blockchains across the world. The drawbacks of energy consumption and scalability are being addressed through technological upgrades and novel protocols. As an emerging technology, its traction and rate of adoption indicate a future when blockchains will shape transactions and records that are transparent, decentralized and cheap.