Cryptocurrencies

Executive Summary

- Cryptocurrencies are transforming our idea of money by using decentralized permissionless networks that are available to all users.

- Cryptocurrencies have several use cases, ranging from being a potential inflation hedge to allowing users to make certain purchases, providing liquidity or even allowing users to vote on the network’s protocols.

- These digital coins are an emerging investment asset class that can be accessed on digital exchanges, during initial coin offerings and through “mining.”

- Since they are permissionless, cryptocurrencies are not affected by geopolitical events that affect sovereign or fiat currencies.

- The regulatory framework is yet to take a clear shape and this can affect both the entire asset class as well as specific cryptocurrencies in several ways such as mining and listing rights, price, fungibility, and liquidity.

Cryptocurrencies are pieces of software that transfer value between users. The word ‘crypto’ comes from the Greek word ‘kryptos’ which means hidden. Like cash, they can be used to buy and sell goods and services. But unlike cash, they are not authenticated by a central authority such as the government or a central bank. They exist on the decentralized peer to peer networks of blockchains and are used for several purposes, such as incentivizing miners, storing value, and enabling other transactions on a blockchain. Since there is no single authority that issues cryptocurrencies, the supply and demand of cryptocurrencies are determined by the users collectively. Simply put, a cryptocurrency is a number that is tracked on a blockchain.

This makes cryptocurrencies a new type of money. While cash or fiat is validated by central authorities, and physical gold and silver are seen to hold value by themselves due to their limited supply, cryptocurrencies gain value inside a protocol that is defined by the users of that protocol. This also allows cryptocurrencies to remain largely unaffected by geographical and political factors that affect sovereign currencies or fiat.

The regulatory framework for cryptocurrencies is still evolving but the key features of these digital assets are already well known.

- All transactions are unbrokered. No intermediary facilitates the transfer of value using cryptocurrencies.

- Since they use blockchains, transactions in cryptocurrencies are pseudonymous and immutable. In other words, the real identity of the users is never revealed by the signatures in a cryptographic transaction. All transactions are recorded chronologically in a blockchain and this makes them difficult to tamper with.

- Cryptocurrency transactions are recorded on a digital decentralized ledger. Any transaction is published immediately to all nodes on the network and upon validation, with become a block at every node.

- The rules for using cryptocurrencies are set by their users, developers and companies that are funded by that cryptocurrency.

- Cryptocurrencies are borderless and are not related to geopolitical trends. In the long run, this can give the asset class a stability that is not available to other assets that are influenced by monetary policies which may or may not be based on sound economic principles and political environments which may or may not be stable.

- Cryptocurrencies are inclusive since users do not need to have a bank or brokerage account to use them. This makes cryptocurrencies attractive to populations that have been left out of traditional banking. Since all that is needed is a phone and an internet connection, any user can transact using cryptocurrencies.

Uses of cryptocurrencies

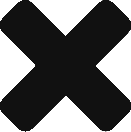

Cryptocurrency coins are different from tokens though both are digital assets. While coins belong to specific blockchains such as Bitcoin on the Bitcoin blockchain or Ether on the Ethereum blockchain, tokens are issued for specific purposes that can be fulfilled on several blockchains. Collectively, coins and tokens have different uses.

Store of Value

Unlike fiat which is issued by governments, cryptocurrencies are governed by users and developers. These rules often deal with how many tokens can be in circulation at a given time. Some cryptocurrencies such as Bitcoin have an absolute limit of 21 million coins that can be mined. Others such as Bitcoin Cash regularly ‘burn’ coins in order control the total supply. A coin is burnt when it is sent to a unusable account. When such limits on supply are placed, the digital asset becomes a store of value that does not get affected by macro trends like inflation and monetary policy.

Medium of exchange

Stablecoins or digital coins that are pegged to fiat like the US Dollar or to physical assets like gold serve as mediums of exchange. Since fiat is still the mainstream currency for transactions, exchanging cryptocurrencies for fiat and vice versa is a vital factor for users of cryptocurrencies. USD-pegged stablecoins are particularly popular: Tether (USDT) was designed as a bridge between fiat and cryptocurrencies, avoiding some of the flaws of fiat such as inflationary trends while also enhancing liquidity in crypto markets. Other USD-pegged stablecoins, the Paxos Standard (PAX) and Gemini Dollar (GUSD), have received approval from the New York State Department of Financial Services.

Utility tokens

These tokens are programmed for a specific purpose and work on specific networks to fulfil that purpose. Utility tokens are usually issued to fund the development of a cryptocurrency though they can also be used later for goods and services offered by the issuer of the same cryptocurrency. Utility tokens can give a right to vote on an issue. They can be used to exchange value for services on a decentralized exchange. They can be rewards to users for doing specific things. Earnings can sometimes be given out as utility tokens. Finally, they can also act as an alternative currency on a blockchain. Through the sale of tokens, the Filecoin community raised $257 million to develop a decentralized cloud storage that users have access to through the utility tokens they purchased.

Security tokens

A security is a tradeable asset that is purchased as an investment in a common enterprise in order to realize a profit. Security tokens are digital counterparts of traditional securities whose value rests on an underlying asset such as a company’s value, gold, real estate etc. Like standard securities, security tokens are ways of raising capital though it allows the company raising the capital to remain private. Equity tokens give their holders ownership rights. Asset-backed tokens represent underlying assets. PAXGand DGX are backed by gold.

Nonfungible tokens

NFTs or nonfungible tokens work like pieces of art that cannot be exchanged or transferred for the same. Unlike currencies of every kind which can be traded for other currencies, NFT’s use case rests on the fact that they cannot be replicated or exchanged and their value is derived from its “one of a kind” characteristic.

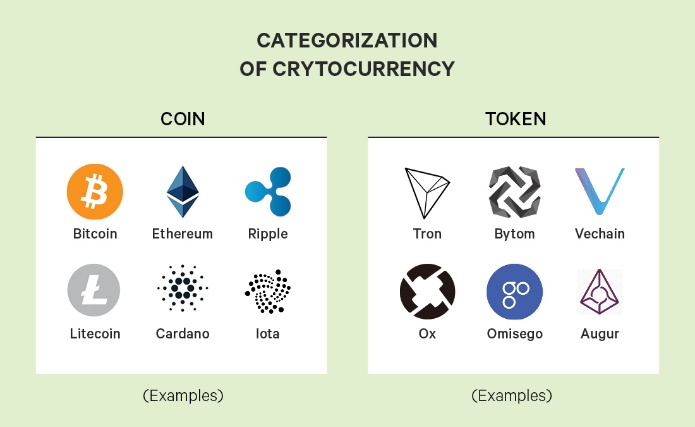

CBDCs

Central Bank Digital Currencies (CBDC) are digital coins that are launched by governments. Unlike cryptocurrencies that are governed by their own communities and which do not have an underlying asset, CBDCs are authorized by their respective governments and are based on the country’s foreign reserves. CBDCs have the convenience and security of digital assets but are also regulated like fiat. Several countries including the UK, the US, China, Venezuela and Singapore are studying the feasibility of their own CBDCs.

Privacy Coins

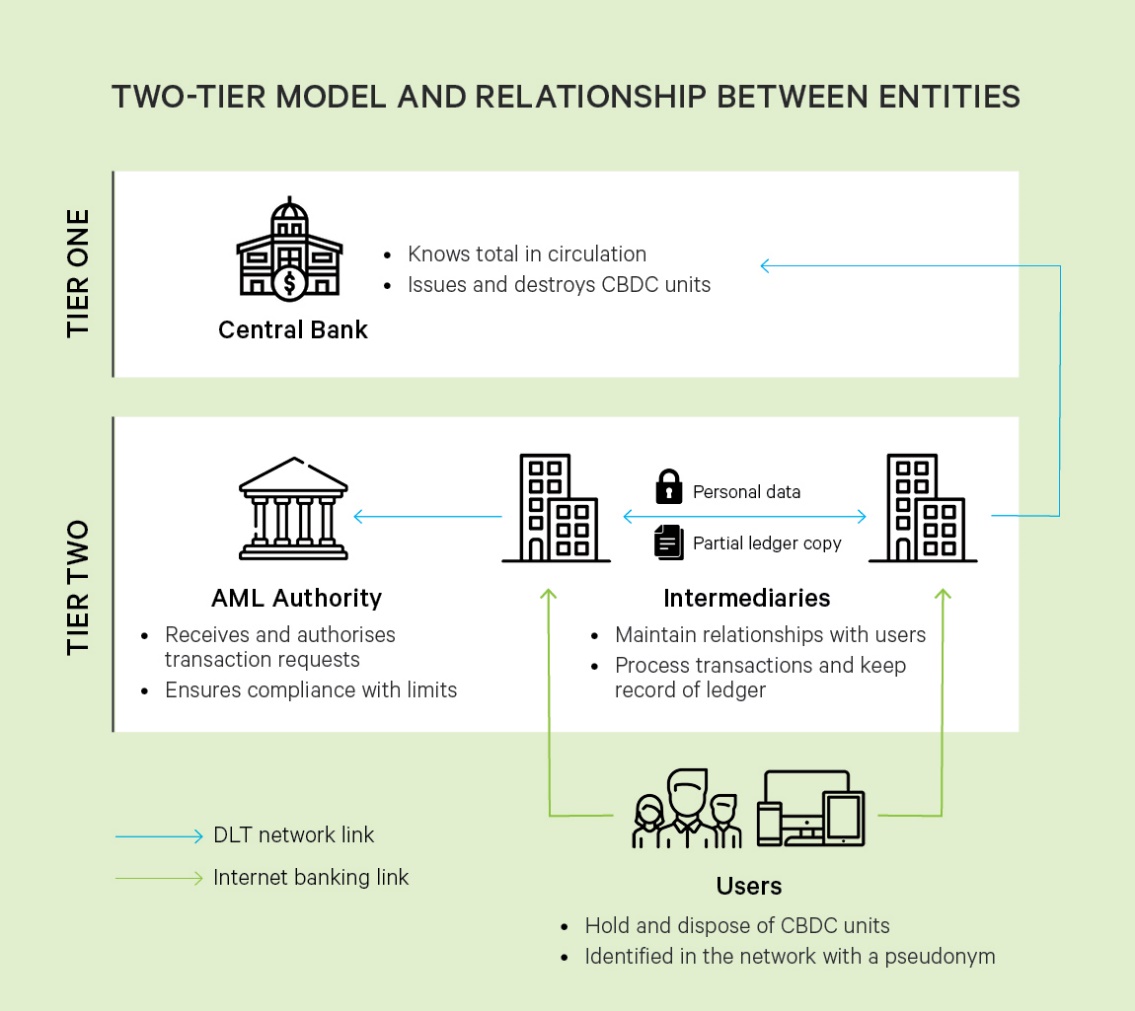

While public ledgers are visible to all users and are only pseudonymous since transactions can be traced back to digital addresses that are linked to actual people, privacy coins seek complete anonymity and non-traceability. They do this through private blockchains and by mixing transactions so that any blockchain analysis will not reveal the actual addresses involved in the transactions. Stealth addresses allows users to generate a new unique address for each transaction while ring signatures mix several signatures so that no signature can be traced back to a transaction. Monero, Dash, ZCash offer this feature. However, privacy coins are risky since they can be used for illegal transactions or for hiding transactions from tax and government authorities. For this reason, they are banned in several countries.

Governance tokens

Governance tokens serve the purpose of giving voting rights to users of a blockchain. Developers create these tokens in order to bring democratic processes in to the evolution of a protocol by allowing users to vote on its future. Users can influence the decision making through their voting rights.

Top cryptocurrencies

Bitcoin (BTC)

Bitcoin or BTC was the first cryptocurrency to be used. Based on Satoshi Nakamoto’s white paper, it seeks to be a store of value and ‘digital gold’ by having an absolute limit of 21 million BTCs that can be “mined.” Bitcoin mining happens through a process called proof-of-work which involves using computing power to solve a cryptographic puzzle. Once the puzzle is solved, a block is completed and the miner earns rewards in Bitcoin. Bitcoin’s share of the cryptocurrency market has been dropping but as the longest existing digital coin, it has seen adoption by institutional investors, corporations and banks at an unprecedented rate during the pandemic.

Ethereum (ETH)

Ethereum is a blockchain that facilitates digital payments and applications. It aims to support developers who use the Ethereum blockchain to carry out various functions such as storing data, and breaking down complex financial data. While these functions are done by intermediaries on the Internet today, Ethereum seeks to put the user in control of all such functions through smart contracts. Smart contracts are automated tools that auto-execute when certain conditions are met. The conditions can be entered into the protocol. So any two users can come together to execute a function through a smart contract. The apps that allow this to happen are called dApps. Users can use any of these dApps after paying a fee in Ether (ETH), Ethereum’s native token. The Ethereum blockchain also supports other tokens that are collectively called the ERC-20 tokens.

Tether (USDT)

Tether is a stable coin that is pegged to the US Dollar. Like other stablecoins, it is a medium of exchange as users convert fiat to cryptocurrencies and vice versa. Tether works on the Ethereum and Tron blockchains. Tether is one of the most traded tokens, sometimes surpassing even transactions in Bitcoin.

Binance Coin

Binance Coin (BNB) was launched as an ERC-20 token but is now the native token of the Binance blockchain. The protocol is set up such that the total number of BNBs cannot exceed 200 million. Binance burns BNBs equal to 1/5 of its quarterly profits. Though it started as a utility token to discount trading fees on the Binance exchange, BNB is now a leading cryptocurrency and facilitates smart contracts on the Binance blockchain to make credit card payments, pay for travel, buy gifts, process payments, make investments etc.

Binance allows traders to convert their dust (tokens that are too small to be traded) into BNBs.

Cardano

Cardano is a decentralized proof-of-stake blockchain that seeks to transform several sectors such as education, retail, agriculture, government, finance and healthcare. It is the first project based on peer research. Through three projects, Atala PRISM, Atala SCAN and Atala TRACE, Cardano addresses and seeks to provide decentralized solutions for identity management to identify fraud and counterfeit, and track supply chains in different industries. Cardano’s native token (ADA) is staked by nodes to support its proof-of-stake validation system.

Dogecoin

Dogecoin started out as a meme of payments coins. It is a combination of a Japanese viral meme Shiba Inu Doge and digital coins and was meant to have ridiculous parameters such as a maximum supply of 100 billion Dogecoins and used an unattractive crypto mining system which rewarded miners randomly. Due to its popularity, even the original limit was removed in order to discourage “hodling”—a pattern of holding on to digital assets because of their fixed supply, particularly in the case of Bitcoin. Eventually, miners’ reward was fixed by the project at 10,000 dogecoins. Since blocks are made every minute, 10,000 dogecoins are released into circulation every minute.

XRP

Ripple’s token XRP is used to facilitate transactions between currencies. XRPs were pre-mined or allocated before the official ICO. As a global payments system, transactions on Ripple are fast and cost less than regular transactions between different currencies. Transactions are validated through a poll amongst participating banks and agents rather than by miners.

USD Coin

USD Coin (USDC) is an Ethereum token that is pegged to the US Dollar. As a stablecoin, it facilitates global payments on the Internet and is always backed by the US Dollar.

Polkadot

Polkadot (DOT) is a multichain platform that allows blockchains to interact with each other. It uses a proof-of-stake system and a governance token (DOT) for the purpose. By connecting multiple blockchains, DOT increases the security and scalability of the platform. Through Polkadot, data can be transferred across public and private blockchains. The relay chain ensures the security of data transfer across heterogeneous chains. Parachains are blockchains that can have their own tokens while parathreads allow the same functions are parachains but on demand. Connections between other blockchains like Ethereum and the Bitcoin network and parachains and parathreads are called bridges.

Binance USD

BUSD is approved by the New York State Department of Financial Services in partnership with Paxos. It is backed 1:1 by the U.S. dollar. It is possible to earn interest on BUSD and use it to pay for goods and services and as a collateral for loans. It can even be used as a cross collateral for futures contracts.

Uniswap (UNI)

Uniswap is an automated liquidity protocol and digital exchange (DEX) on the Ethereum blockchain. It is easy to swap from one ERC-20 token to another using its governance token, UNI, on the decentralized network. Uniswap uses a ‘Constant Product Market Maker Model’ to determine the prices of tokens that are bought and sold using its smart contract.

With over 8,100 actively traded coins, the number of cryptocurrencies and their use cases are exploding and collectively, this asset class is still in the early stage of its growth. However, the several use cases of digital coins and tokens, the robust decentralized networks on which they work and the speed, security and scale of transactions make them highly attractive both from the point of view of financial transactions and from that of investments. Regulatory measures and the establishment of standard practices will shape the future of cryptocurrencies and this can impact the entire asset class in terms of mining and listing rights as well as specific cryptocurrencies’ price, liquidity and fungibility.