Executive Summary

- Decentralized Finance or DeFi is set to radically alter the processing of financial transactions in a way that ensures speed, security, cost efficiency and inclusivity.

- DeFi seeks to facilitate every type of financial transaction, including lending, borrowing, and trading besides payments.

- Smart contracts are auto-executing protocols that are at the heart of DeFi

- dApps allow any user to create smart contracts without having to approach banks or brokers.

- The blockchain technology used in DeFi makes all transactions secure, tamper-resistant, immutable, and pseudonymous.

- The several use cases of DeFi and the autonomy it promises to users also pose challenges from a regulatory point of view.

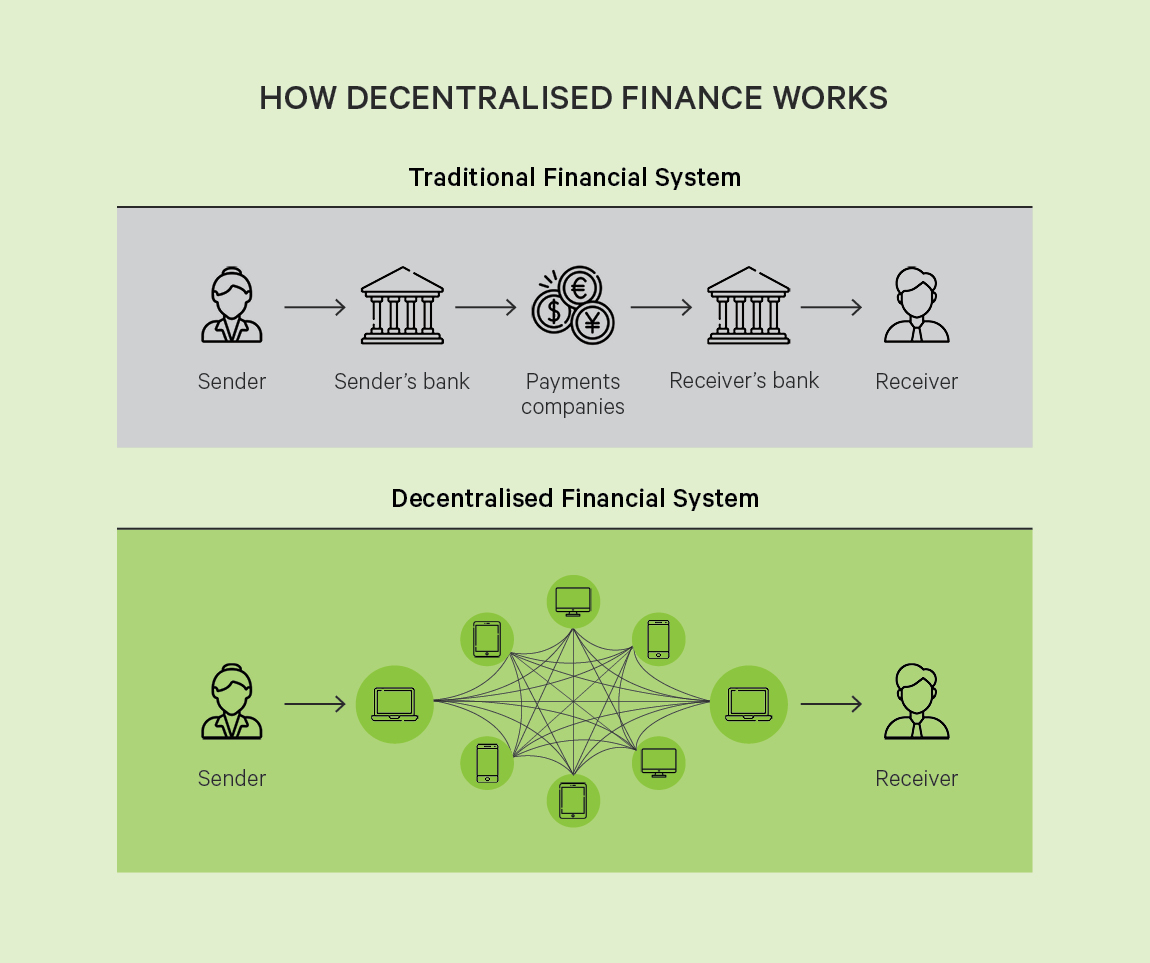

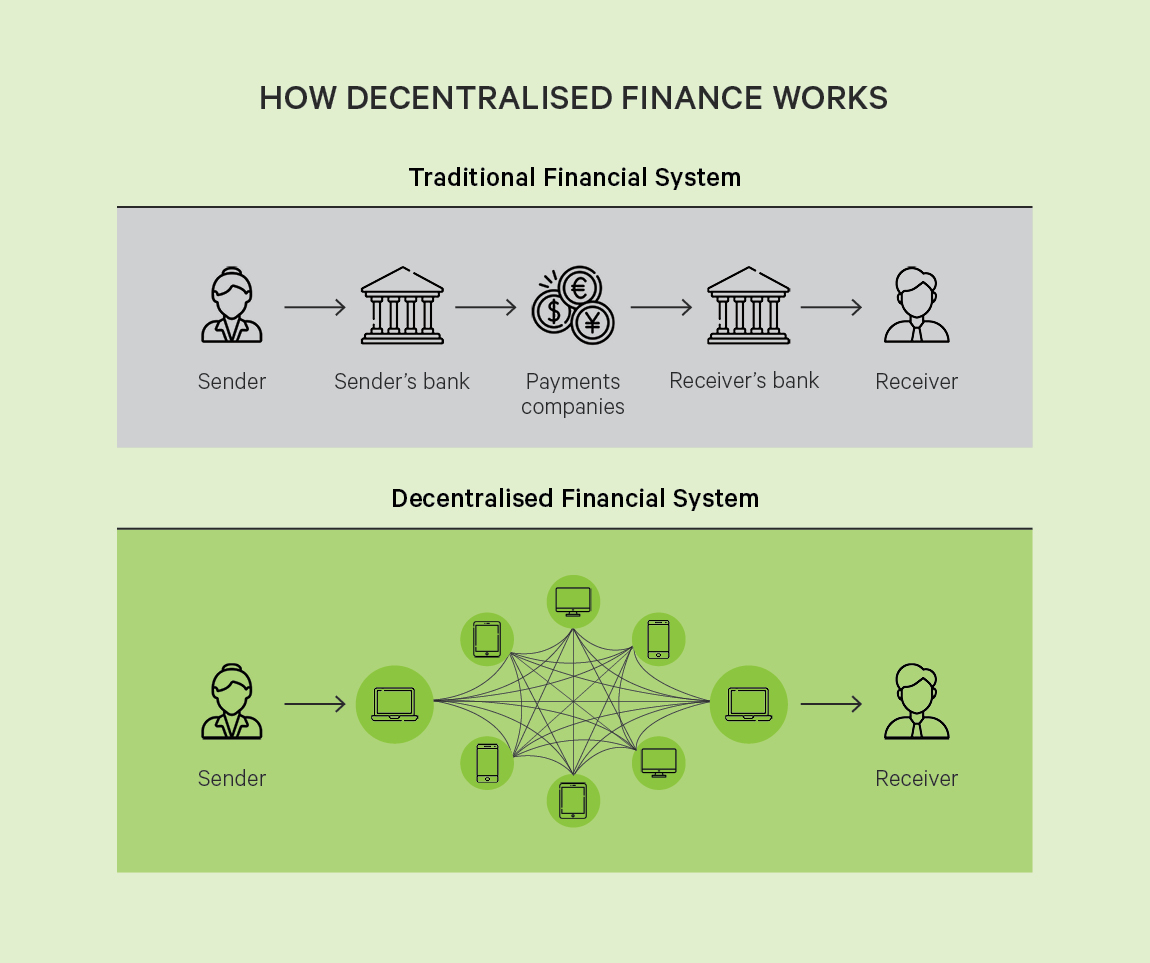

Decentralized Finance or DeFi allows financial transactions of several types on a blockchain. By expanding the capabilities of blockchain technology beyond record keeping, DeFi is set to revolutionize the way we transfer value through payments, lending, borrowing, and trading. Like the distributed ledger that is used in the Bitcoin network, there is no custodial and third-party agency between any two users in a transaction using DeFi networks. However, unlike Bitcoin which still relies on centralized digital exchanges, DeFi operates through ‘smart contracts’ which are auto-executing protocols that are set up by independent transacting parties.

Features of the DeFi Ecosystem

DeFi projects use dApps or decentralized applications that anyone can develop and use. These applications use utility or native tokens or DeFi tokens that facilitate transactions. These DeFi tokens serve many purposes other than just making payments or being a store of value.

Like Bitcoin, DeFi’s software runs on a blockchain that makes every transaction immutable, tamper-free, pseudonymous, and public. All nodes on the network that a dApp uses have a record of the transactions between cryptographic addresses that they can view.

DeFi operates primarily on the Ethereum blockchain though there are other DeFi projects that run on other networks such as the Binance network. Additional networks, such as Cardano, Solana, Polkadot are also emerging as DeFi adoption grows.

DeFi eliminates the need for an intermediary or agent through smart contracts and by removing technological and regulatory barriers to entry for everyone. Smart contracts are protocols that are automated and fulfilled when certain conditions are fulfilled. Anyone with a computer or phone and a network connection can make or enter into a financial transaction with another user through a smart contract. This removes all third party or centralized controls and makes financial transactions borderless while also removing regulatory mediation and technological control.

Multi-chain protocols are likely to dominate the growth of DeFi as users develop and execute smart contracts across different blockchains. dApps that have cross-chain compatibility are also likely to emerge as favored instruments for financial transactions.

Use Cases of DeFi

Since any user can enter into an agreement and even develop a smart contract through dApps, DeFi is inclusive and borderless. The long and tedious ‘Know Your Customer’ (KYC) process that banks and brokers use to ensure the authenticity of transactions is avoided altogether, allowing anyone to enter into a financial agreement.

The heavy fees charged for financial transactions are also lowered significantly as users typically pay a much lower transaction fee since there is no mediating agent.

Transactions are also faster due to the lack of the lengthy verification process that usually is required by banks and brokers.

The flexibility and options available in DeFi are also an advantage as users can choose from several dApps or develop their own, based on their preferred features and the nature of the transaction.

DeFi opens up several ways of using assets as collateral for loans. Users can use a stablecoin like Tether or the native token of a DeFi blockchain like Ether or even real-world assets that are made available through securitized tokens as collateral against loans.

Non-performing loans or bad debt is a risk that banks face and frequently, identifying a bad debt takes several days or even weeks. However, on a DeFi network, this can be identified instantaneously due to the digital distributed ledger that dApps use.

dApps can also interact with each other and this can help users find various ways of generating income or capital gains from their digital assets on a DeFi network. For example, Ether can be converted to the stable coin DAI which can then be placed in a DeFi protocol that allows the DAI to earn interest. Alternatively, the DAI can be placed in a liquidity pool that generates transaction fees for the user.

Since the KYC process does not exist in DeFi, financial tools that were not available to those without a bank account are now within their reach. DeFi makes finance inclusive.

Since the transaction history is preserved on the Ethereum blockchain or a similar blockchain, it is much faster and cheaper to assess the authenticity of a financial instrument.

The blockchain technology that underpins DeFi ensures that every transaction is immutable, tamper-free, and pseudonymous.

Challenges

Due to the several ways in which DeFi is expanding, having standard regulatory frameworks that effectively cover this rapidly evolving space is difficult. This can become a serious obstacle as the use of DeFi explodes.

The link between on-chain and off-chain data is difficult to make and maintain. These instruments called oracles also need to be constantly updated.

Despite the security that blockchains offer, hacks and malware have frequently revealed chinks in the network that need to be removed.

The high volatility of cryptocurrencies makes holding DeFi tokens unattractive for some users who have a low tolerance for market swings.

The rising fees in the Ethereum network is making DeFi transactions through dApps on the network less attractive. Unless Ethereum successfully moves to a proof-of-stake model that will reduce transaction time and fees, the cost of executing and verifying financial transactions through Ethereum based dApps will be a growing challenge.

For loans, DeFi projects frequently need to maintain a large collateral to make up for the lack of regulatory oversight. Sometimes, as in the case of Maker DAO on the Ethereum blockchain, the collateralization ratio can be as high as 150% of the loan raised against the collateral.

DeFi has seen increasing adoption as users seek new ways of transacting that are fast, cost efficient and tamper proof. DeFi extends the capabilities of blockchain technology beyond just payments. The borderless and distributed network can allow the unbanked people in remote corners of the world to access financial markets in their own country and outside it. The autonomy that DeFi promises wherein anyone can set the terms and framework for a financial transaction is likely to revolutionize the financial system. Nonetheless, the challenges and the difficulty of formulating a single or standard regulatory policy and the difficulty of accessing off-chain data will have to be addressed in novel ways for DeFi to gain the level of acceptance that is required if it is to become a viable alternative to the existing financial system.